Professional accounting services in the Netherlands

Our accounting firm in the Netherlands is specialized in assisting corporate clients with a wide array of financial services. Our experts offer tailored solutions for each client and our services are suitable both for Dutch resident companies as well as foreign businesses that operate within a branch or a subsidiary in the Netherlands.

Our Dutch accountants and advisers can help you with more than simple accounting services. We can provide support for:

- – financial consultancy and administration;

- – VAT registration for companies and VAT compliance;

- – audit in the Netherlands;

- – payroll and other matters related to company management.

Our team of Dutch accountants can be contacted in some of the largest cities in the Netherlands and our accounting services are also available in cities such as Rotterdam or Amsterdam.

|

Quick Facts

|

|

|---|---|

|

Accounting services available

|

Tax registration, VAT and EORI registration, financial statement filings

|

|

Payroll services available

|

Employee and employer registration, HR, employment taxes computation

|

|

VAT registration threshold

|

Annual turnover of 100,000 EUR

|

|

VAT rates

|

21% (standard rate), 9% and 0% (reduced rates)

|

|

Corporate tax rate

|

15% (for the first 245,000 EUR), 36,750 EUR + 25% for amounts of more than 245,000 EUR

|

|

Dividend tax rate

|

15%

|

|

Payroll taxes

|

27.65% contributions applied to employees, 2.94% or 7.94% (unemployment premium) and 8.55% ( disability insurance) and 5% (childcare) applied to employers. Wage tax 9% to 51% on employees salaries.

|

|

Number of double taxation treaties (approx. )

|

Approx. 100

|

|

Financial statement filing deadlines

|

Within 12 months from the end of the financial year, or 8 days from creation, depending on the legal entity.

|

|

Audited financial statement filing required (YES/NO)

|

YES

|

| Accounting standards | The International Financial Reporting Standards (IFRS) and the Dutch Accounting Standards |

|

Tax minimization/planning advice (YES/NO) |

YES, we offer tailored tax planning solutions |

|

Audit services (YES/NO) |

YES, we offer: – internal audits; – external audits; – compliance audits. |

| Registration as employer/ for employees for social security purposes (YES/NO) | Yes, we offer full employer/employee registration support in the Netherlands |

| Representation with tax authorities (YES/NO) |

Yes, we provide tax representation support |

| Tax authorities in the Netherlands |

Tax and Customs Administration in the Netherlands, the Ministry of Finance |

| Accounting solutions for small businesses (YES/NO) |

Yes, our services are also available for sole traders, micro-enterprises, startups |

| Support for foreign-owned companies (YES/NO) |

Yes, we offer tailored solutions for foreign companies in the Netherlands |

| Our locations |

Amsterdam, Rotterdam, Breda |

| Advantages of working with a Dutch accounting firm |

– Integrated services; – access to modern accounting software; – personalized approach. |

Top quality accounting services for Dutch companies

Effective accounting is important for any type of Dutch company, both large enterprises or small and medium sized companies. It is an important practice not only for the internal affairs of the company but also for other interested parties like shareholders. A company with good financial records will be of more interest to potential new shareholders and creditors.

When running a business in the Netherlands, it is mandatory to register for taxes and to comply with the annual accounting procedures. The services provided by our Amsterdam accountant can help investors in performing such procedures as stipulated by the applicable law (they can vary based on the type of company registered in this country).

Our accountant in Netherlands can help you in registeringwith the relevant Dutch tax authorities. The services we provide in the field of accounting include:

- – tax register;

- – VAT journals;

- – preparing and submitting theannual financial statementsand many others.

In case you need these services in another country, for example in Malta, we can put you in contact with our partners who are experienced accountants.

Services provided by our accountants in Netherlands

Our clients can rely on our expertise for a wide range of services. Our Dutch accounting firm can offer tax advice in accordance with the latest regulations imposed by the relevant authorities which, in this case, are represented by the Tax and Customs Administration in the Netherlands and the Ministry of Finance. Our accountants can assist in matters such as:

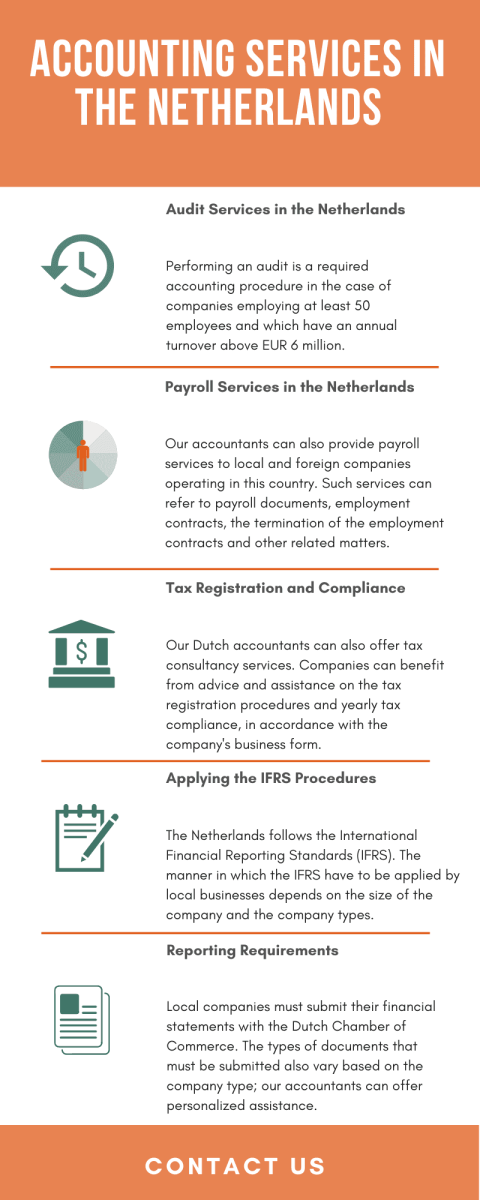

- • audit services in the Netherlands – audit is a required procedure for Dutch companies hiring at least 50 employees or for businesses that have a turnover above EUR 6 million/year;

- • professional tax consultancy – preparation of thetax returns and assistance following the procedures established by the localtax institution;

- • payroll services – processing the monthly payroll documents, employment contracts, termination of employment contracts and others. Outsourcing the payroll in the Netherlands can bring various advantages to your company. Among them we mention that accounting and tax compliance will be made easier, the record of employees’ personal and vacation time spent will also be available in the shortest time, as well as availability of a wide range of reports in accordance with your needs.

- • corporate tax compliance – the corporate tax in the Netherlands is applied on a progressive basis, depending on the company’s yearly taxable income.

By working with our group of accountants in Netherlands, you will benefit from the following services:

- – organization, conducting and monitoring the accounting and legal documents;

- – full or partial outsourcing of the accounting department;

- – drawing up the periodic layout of the accounting balances, accounting journals and financial histories;

- – preparation of the balance sheet, income statement and notes;

- – review and correction of any accounting document;

- – analytical management accounting

- – both private and legal expertise regarding the accounting of the company, as well as the analysis of technical accounting procedures, the position and operation of the company in terms of creditworthiness, profitability and risk;

- – implementation of external audits (both contractual and statutory) that result in a complete diagnosis of the financial situation of your company and your accounts to third parties;

- – consolidation of small groups (SME ‘s and association’s);

- – formatting and checking accounts of an inheritance, custody or provisional management;

- – advice on management and prognostication;

- – advice on strategic management (audit, evaluation, review of provisional accounts, management control from a strategic perspective).

If you need an Amsterdam accountant you can rely on our team.

We have an extensive network of partners, who are experts in legal, company formation and accounting matters, therefore if you intend to open a company in a foreign jurisdiction, such as Cuba, or if you need legal services in this country or in any other jurisdiction, we can put you in contact with our affiliates.

Why Choose our Accountants in Netherlands

When it comes to the reasons why we strongly believe you should choose our Dutch accounting firm, one of the most important ones is that that we always treat your business as if it was our own. Our experienced accountants in Netherlands aspire to fully understand what your business objectives and aspirations are and to help you reach them in due time.

We know the concept of money value

As an accounting and audit firm in the Netherlands, we are aware of the value of money and of each investment you make in your business. That is why we strive to provide you with outstanding service rendered at some of the most competitive costs. Our fees are communicated upfront in a transparent manner and we offer flexible payment plans so that you can work out an affordable cash flow model.

Exceptional accounting service in the Netherlands

When dealing with each of our clients, one of the main reasons why our clients choose us is that we aim for optimized results and, most of all, accuracy. As experts in the Dutch tax legislation, we possess the knowledge to determine the optimal solutions to minimize your taxation expenditures as much as possible, minimizing the general risks of your business. Each return that we make for our clients is reviewed carefully for precision.

Periodical planning

Even though we deliver all the services a customary accounting firm in the Netherlands does, we are aware that successful companies undertake periodical strategic planning. We can assist you with this type of planning, helping you put together a strong and viable financial plan. After this is achieved, we can also help you monitor your progress along the way, making sure that your business stays on track and you achieve your targets.

Strong reputation in the Netherlands

Another reason why our clients choose us is that we have been able to build a solid reputation, working with numerous international and local businesses which come back each year to repeat business and which send us many referrals as a result of their successful collaboration with us. We are entirely committed to provide our clients with the most qualitative accounting services with the least hassle; therefore, in time, we were able to build a reputation which our clients have come to trust and value.

How can our Amsterdam accountants assist in VAT registration?

Our team of Dutch accountants can provide advice on how to register a company for VAT purposes in this country. Any business operating here is legally required to register for VAT and one of the main aspects available in this case is obtaining a VAT number.

TheVAT number is necessary for filing VAT returns, which are compulsory documents that have to be submitted by most of the companies that operate on the Dutch market. The VAT returns have to be filed with the Dutch Tax and Customs Administration and our accountants can assist with advice regarding the procedure.

The VAT returns can be filed on a monthly, quarterly or yearly basis. However, there can be exemptions from filing the tax returns in the situation in which the activities developed by the company are not taxed for VAT purposes. Foreign companies that are performing taxable activities in the Netherlands are also required to file regular VAT returns.

What are the VAT registration procedures in the Netherlands?

A part of the accounting system in the Netherlands is represented by the VAT registration. Companies performing taxable activities in this country are required to register for VAT in specific conditions. This tax is also imposed to foreign companies selling goods or services in the Netherlands, and this includes online businesses as well. If you need an Amsterdam accountant who can help you register your Dutch company for VAT, you can rely on one of our experts.

In the case of foreign businesses operating in the Netherlands that were registered in one of the countries that are members of the European Union (EU) and which sell their products through the internet to Dutch citizens, the VAT registration is mandatory once the company has sold goods with a value of minimum EUR 100,000 per year.

Please note that in the case of foreign companies that reside outside the EU, it is legally required to appoint a Dutch fiscal representative; this regulation does not apply to the EU based businesses operating in the Netherlands; our team of Dutch accountants can offer more information with regards to this requirement.

During the VAT registration, the company’s representatives are required to provide a set of documents in order to be legally registered for VAT purposes in this country and, in this sense, it is necessary to provide the following:

- – the company’s articles of association;

- – the company’s VAT certificate issued in the country where the company was incorporated;

- – an extract from the Trade Registry operating in the country where the company is a tax resident.

Businesses requesting a VAT number in the Netherlands will obtain their VAT number in a period of approximately two weeks since the moment they applied with the local institutions. The standard VAT number in the Netherlands is comprised of the prefix NL, designating the country, and a code formed from nine digits, which is continued by the characters B01 or B02. Most of the companies have a VAT number ending in B01, as the B02 characters are assigned to businesses which are part of a VAT grouping.

What are the VAT requirements for Dutch sole traders?

The sole trader in the Netherlands represents a way of doing business as a natural person, who carries a specific business activity in his or her own name. This is the simplest structure that can be registered in this country and, due to this, it also benefits from the simplest accounting and reporting requirements, which can be presented at length by our team of Dutch accountants.

Even it represents a very simple business structure, the sole trader is set up with the purpose of carrying business activities, which means that it will also be liable for taxation. This takes into consideration the VAT registration as well. The legislation regulating the VAT registration for sole traders was recently changed and those who want to operate under this structure are invited to address to our team of accountants in the Netherlands for in-depth advice.

One of the main changes related to the issuance of a VAT number for a Dutch sole trader is that the Chamber of Commerce will stop issuing VAT numbers for this structure starting with 1st of January 2020 (this was the main institution that administered this matter). Starting with January 2020, the institution in charge with the issuance of the VAT number will be the Tax and Customs Administration.

The procedure for registering a sole trader will still be administered by the Chamber of Commerce, but the issuance of the VAT number will fall under a different institution with the purpose of protecting the sole trader’s identity, as the VAT number for this structure was connected with the owner’s private citizen service number.

Since the data on commercial entities registered with the Chamber of Commerce can be accessed freely, the Data Protection Authority declared that this is a violation of the GDPR rules and this is why the legislation was recently modified. Sole traders that are already registered in the Netherlands with their private citizen services number will be issued with a new code.

Accountants in Amsterdam

Amsterdam: the place to invest

If you plan to open a company in the Netherlands or if you already run a business here for which you need accounting services, you have reached the right place. Our Amsterdam accountants are specialists in the financial sector and they will offer you professional accounting services. Contact us and you can be sure that all your tax obligations are fulfilled correctly.

As the Netherlands’ Government set laws and regulations that increase the efficiency of companies and facilitate the entrepreneurial activities, by using our advice you will be sure to benefit from all the advantages the country brings in terms of business. We are a valuable asset for your company and we guarantee that your business will run smoothly in terms of accounting.

Our Amsterdam accountants offer services in the following financial activities:

- – tax Registration and Compliance;

- – tax returns preparation and filings;

- – accounting and annual tax filings;

- – debt monitoring and risk assessment;

- – consolidation;

- – forensic accounting: special purpose engagement, contracts reviews, financial statements analysis.

In addition, we also offer tax consultancy services, meaning that we assist our clients in organizing the needed documents, as well as organizing the financial department and arrange the flow of the accounting policies. With our help, you will have all the needed documentation for a bank loan, but also will you have access to a complete professional quality analysis of receivables and payables. Therefore, you will always be updated with the taxes owed.

Payroll services and consultancy for Netherlands Banking System

As Netherlands signed many treaties that allow business entities to avoid double taxations, it is a great business environment for investors. If you choose our experienced Amsterdam accountant, your company will always be updated with the Double Taxation treaties and you will benefit from all the offers of such treaties.

Our accountants in Amsterdam will offer consultancy regarding the Netherlands banking system. By working with us you will have access to accurate and update information regarding loans, European funds and other banking system news and laws.

Moreover, we also offer payroll services in the Netherlands, so you can trust our expertise in statement of salaries, as well as in the taxation system procedures. You will always know the situation on the payrolls. In addition, we will help you prepare the labor contracts, as well as salary certificates and notes for staff dissmisal.

What are the main accounting standards in the Netherlands?

Our accountant in Netherlands can offer in-depth assistance on the accounting standards applicable to both local and international businesses, which are completed following the European Union’s legislation. The Dutch accounting system is based on the International Financial Reporting Standards (IFRS). The accounting procedures that have to be met by a Dutch company vary depending on the size of company.

It is also important to know that the accounting requirements are to be fulfilled in accordance with the tax year, which is generally the same with the calendar year. Our qualifications are internationally recognized per the industry standards and we pride ourselves in having an important number of international clients.

We can respond very promptly and in a professional manner to all received inquiries. Our Dutch accountants can provide professional assistance, tailored in accordance with the needs of your business. We offer personalized consultancy and give each client the time and attention he/she deserves in order to solve any problem the best possible way. Also, we can recommend you our partners in Singapore, in case you need professional accounting services for your Singapore business.

As presented earlier in this article, our team of accountants in Netherlands can help businessmen with advice on the legislation regulating the accounting standards in this country; our accountants can also prepare the necessaryfinancial documentsof a company that needs to file its financial situation with the local tax institutions.

One of the main aspects concerning the Dutch accounting standards refers to the duration of the financial year, which generally is the same with the calendar year. However, it is necessary to know that the Dutch legislation allows deviations from this rule, as long as this is clearly stipulated in the company’s articles of association. Besides this, the duration of the financial year can also be different from the calendar year in the year when the business was incorporated in the Netherlands or upon its liquidation. Besides these, foreign businessmen should also know the following:

- • companies incorporated in the Netherlands and public companies incorporated abroad follow the International Financial Reporting Standards (IFRS);

- • small companies in the Netherlands can choose between two main reporting systems;

- • thus, a reporting system is formed by the Dutch Civil Code (Book 2), Dutch Accounting Standards for Small Entities and the Dutch Accounting Standards for Medium Sized and Large Entities;

- • another reporting system for small companies is given by the IFRS Standards (the EU model) and the Dutch Accounting Standards for Medium Sized and Large Entities;

- • businesses operating as medium-sized companies can follow the Dutch Accounting Standards for Medium Sized and Large Entities;

- • the latter type of companies may also perform their accounting procedures following the IFRS Standards (EU system), combined with the Dutch Accounting Standards.

What defines the size of a Dutch company?

The basic reporting procedures that must be completed by each company operating in the Netherlands depend on the size of the company. Before contacting an Amsterdam accountant, you should know that in the Netherlands, the size of the company is defined by a set of factors, which are represented by the following: the company’s annual revenues, the number of persons employed by the company and the assets owned by the company. In the Netherlands, the following apply:

| micro company | it has less than 10 employees, its revenues are below EUR 0,7 million, while the company’s assets are of less than EUR 0,35 million |

| small company | it employs maximum 50 employees, the company’s revenues stand at maximum EUR 12 million and it holds assets with a value of less than EUR 6 million |

| medium sized company | it has maximum 250 employees, revenues of maximum EUR 40 million and assets of maximum EUR 20 million |

| large company | it employs more than 250 employees, its yearly revenues are above EUR 40 million and it holds assets of minimum EUR 20 million |

In order to be included in one of the above mentioned categories, a company in the Netherlands has to fulfill at least two of the three conditions mentioned for each class of companies for a period of minimum two years (two financial years); our accountant in Netherlands can provide more information concerning this matter.

The video below provides a short presentation on the main accounting services that can be provided by our Dutch accounting firm:

What are the reporting requirements in the Netherlands?

Companies that are registered in the Netherlands have to complete their annual financial accounts, that have to be submitted with the Dutch Chamber of Commerce. This accounting procedure is compulsory for businesses registered as private limited companies, public limited companies, cooperatives, general partnerships, limited partnerships, associations or foundations.

The financial statements in the Netherlands refer to the company’s balance sheet, the profit and loss account, the annual consolidated accounts and the explanatory notes. The manner in which these documents have to be submitted depends on the size of the company; for example, in the case of a small and medium-sized company, it is allowed to provide a simplified balance sheet and explanatory notes.

A small company does not need to submit the profit and loss account, while for a medium-sized company, the document is required, but only an abridged version. Furthermore, as a medium-sized company in the Netherlands or a large business, the reporting requirements stipulate that the company’s financial statements have to be audited, following the procedures for audit in the Netherlands. This is done by appointing an external auditor, who has to be a certified accountant in the Netherlands; he or she may also be a foreign person, but who has obtained a license to practice in this country.

FAQ on accounting matters in the Netherlands

The Tax and Customs Administration in the Netherlands and the Ministry of Finance set forth and enforce the taxation laws in the country.

Yes. Entrepreneurs in the Netherlands who provide taxable goods and services must register for VAT.

Companies in the Netherlands, either local or non-residents, must submit annual accounts, annual financial statements and perform an annual audit.

Only medium and large companies in the Netherlands are required to submit an annual audit report. This evaluation is done by an independent and accredited auditor.

The annual report and annual financial statements that need to be submitted by Dutch companies include: consolidated financial statements (balance sheets, income statements, cash flow statements, etc.), company financial statements (balance sheets, condensed income statements) and other relevant information as well as the appropriation of profit.

The Generally Accepted Accounting Standards in the Netherlands (GAAP) and the International Financial Reporting Standards (IFSR) are two accepted financial reporting and accounting principles.

Dutch companies must pay a corporate income tax of 20% or 25%. Other taxes like the real property tax, the transfer tax, inheritance/estate tax or social security contributions are also payable by Dutch companies.

The 30% ruling is a tax exemption that applies for employees who work in the Netherlands. If the eligibility criteria are all met, the employer is granted a tax allowance amounting to 30% of the gross salary which is offered to the employee (as benefit for the expenses of working in another country).

The social security contributions are the most important taxes on salaries. This tax is progressive.

The Netherlands is considered a tax haven by many foreign investors because of its favorable fiscal climate.

What are the bookkeeping requirements in the Netherlands?

Bookkeeping refers to all the financial transactions of a taxable entity in the Netherlands, that have to be recorded in specific documents. The bookkeeping requirements vary based on the type of company that is registered here; a detailed presentation on all the requirements can be presented by our team of Dutch accountants.

In the case of a sole trader, there are no specific requirements and no specific bookkeeping programs. As a general rule, local sole traders register their financial transactions by using Excel. Businesses in the Netherlands are required to keep records of all the company’s transactions for a period of at least 7 years.

You can contact our accounting firm in the Netherlands for a complete list of our services and detailed information about our offers. Our clients are local and foreign businessmen interested in starting a business in the Netherlands or entrepreneurs who have already a successful enterprise.