Our accounting firm in the Netherlands is at your disposal with various services, among which payroll maintenance. This is a key aspect when having a business, as it implies handling salary, health insurance, and other mandatory requirements related to employment, as well as your relationship with the authorities as an employer.

Below, our Dutch accountants present the main payroll services we can provide for you in this country.

Payroll solutions provided by our Dutch accountants

By choosing to outsource the payroll activity to our accountants in the Netherlands, we guarantee the following services:

- collecting and verifying the wage data;

- payroll services;

- the delivery of pay slips and centralizers of wages and taxes;

- financial interface with the accounting system;

- interface with banking applications and payment of salaries;

- payment of fees and contributions in cash accounts;

- standard reports to management;

- legal reports, including the National Institute of Statistics;

- complex reporting in accordance with your company’s needs;

- consultancy for your employees on the calculation of wages, taxes and contributions;

- self-service – employees and management portal;

- help-desk services and legal information;

- registration with the tax authorities;

- advice about the available tax-free allowances;

- submission of wage tax returns.

| Quick Facts | |

|---|---|

| Employee/Employer Registration Services (YES/NO) |

YES |

|

Payroll Setup Services (YES/NO) |

YES |

|

Employee Records Setup and Maintenace Services (YES/NO) |

YES |

| Employee Remuneration Computation |

Salary, bonuses, overtime, incentives, allowances |

| Mandatory Contributions for Employees | Social security contributtions for welfare and insurance benefits |

| Employment Contributions for Employers |

Employer's health care insurance contribution |

| Payroll Reporting Requirements |

Monthly electronic filing requirements |

| Social Security Contribution for Employees | 22. 23% |

| Social Security Contribution for Employers | 27. 65% |

| Special Regulation for Foreign Employees (YES/NO) | YES, the 30% ruling system and other tax deductions apply to foreign employees |

| Special requirements for Dutch citizens working abroad (YES/NO) | Dutch citizens are advised to check with our accountants the rules they need to abide by when working in another country in order to avoid double tax liability. |

|

Assistance in drafting labor contracts (YES/NO) |

Yes, we can draft various types of labor agreements. |

|

Specific services for foreign companies (YES/NO) |

Yes, we can offer tailored support to foreign companies hiring personnel (local and foreign) in the Netherlands. |

| Assistance in employment regulations (YES/NO) | Yes, you can contact us for support in understanding the Dutch Labor Code. |

| Requirement for foreign employers in the Netherlands |

Registration with the Dutch Tax and Customs Administration |

| Salary payment frequency |

Most companies pay salaries on a monthly basis. |

| Support in setting up bank accounts for employees (YES/NO) |

Yes, we offer support in setting up current accounts for employees. |

| Employee benefits (if any) |

– vacation allowances, – paid sick days, – sickness benefits, – maternity and paternity leave, – various deductions. |

| Tax advice related to employment incentives (YES/NO) |

Yes, our Dutch account firm can offer support in filing for various incentives as an employer or employee. |

| Why work with us | Our services are available for small and large companies, local or foreign, with a focus on the specifics of the respective business. |

You can contact us if you need more details about our services which are specific to a payroll company Netherlands.

If you wish to know more about payroll Netherlands, you can reach out to our specialists.

Do reach out to us if you wish to know more about these payroll Netherlands services.

Tailored payroll assistance in the Netherlands

Starting a business in the Netherlands is quite simple and easy in terms of registration, however, when it comes to hiring employees there are several procedures that must be completed. Among these, we mention the following:

- the registration of the company as an employer with the Tax Authority in the Netherlands;

- the registration of employees with the same authorities, plus their registration for social contribution and pension benefits;

- the creation of the HR department or direct outsourcing of this department with an accounting firm in the Netherlands;

- the setup of the payroll which implies registering each employee with the company’s own system.

Our accountants in the Netherlands can offer tailored payroll services which start directly with the registration of the company and employees with all relevant authorities. If you need other services in the Netherlands, such as debt recovery, we can put you in touch with our experienced lawyer.

Registering as an employer in the Netherlands

A Dutch company is required to register with the Tax and Customs Administration when it hires its first employee. It should be noted that there are different forms that must be filled for local and foreign companies operating in the Netherlands. The registration as an employer is usually completed with the local tax office in the city the company is registered in.

Based on the information filed with the tax office, the company will receive:

- its payroll tax number;

- the payroll tax return letter in which the tax return periods are provided;

- information about the sector in which the company must pay the insurance contributions;

- information about the percentage to be directed to the Return to Work Fund.

Our accounting firm in the Netherlands can handle the registration for payroll for your company. We can also assist foreign companies seeking to establish operations here with dedicated accounting services, including payroll setup.

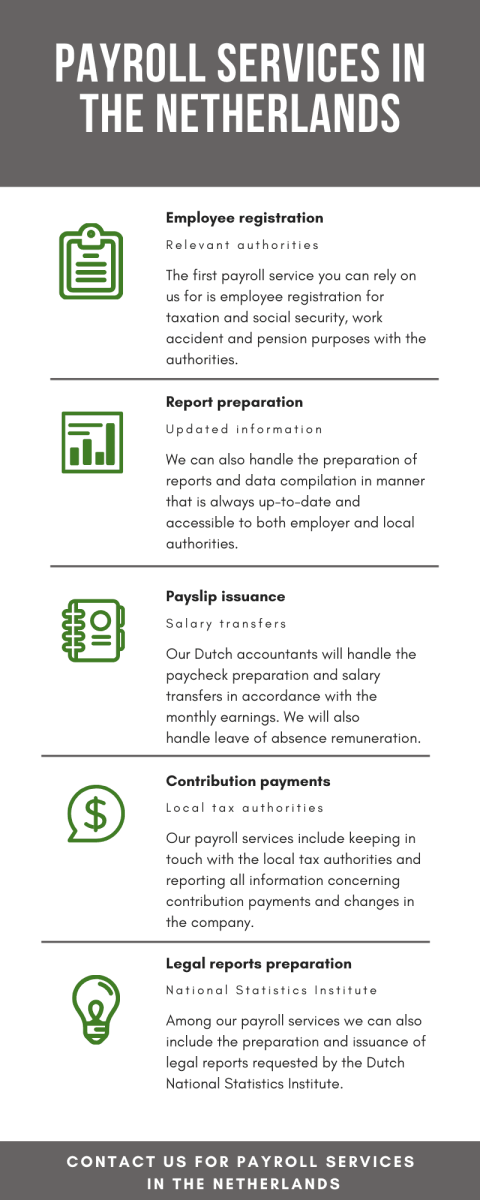

You can read about our payroll services in the Netherlands in the infographic below:

Registering employees for payroll in the Netherlands

Once the first step of registering the company as an employer is completed, our Dutch accountants can handle the registration of all employees with the tax authorities. This procedure can be quite strenuous for companies with large numbers of workers, which is why it is best left with a professional accounting firm.

Our Dutch accounting firm will provide case-to-case assistance to small businesses and startups in order to help them achieve their targets instead of dealing with administrative issues.

Payroll services for small businesses in the Netherlands

Small companies have specific needs and need to make sure they work as effectively as possible. This is one of the most important reasons small business owners in the Netherlands hire specialists to handle specific aspects related to employment and payroll which provide them with solutions that have been used before and that work.

Our accounting firm in the Netherlands can provide tailored payroll services to small companies that need to benefit from quick and effective solutions that do not cost them as much as it would cost to create an entire department.

We can set up and administer the payroll in the Netherlands for a small business in order to help their employees and manager to focus on their tasks and grow their companies. These solutions also work for Dutch startup businesses that need to pay attention to other aspects of their operations rather than on employment matters.

Setting up the payroll for Dutch medium and large-sized companies

When it comes to medium and large-sized companies, the number of employees is higher and so will their accounting needs. With a vast experience and presence on the Dutch market for years now, our accountants and auditors have the necessary skills to set up and administer the payroll of such businesses.

If you need specific solutions for an effective payroll, do not hesitate to rely on our services.

Specific payroll services for Dutch companies with foreign employees

The Netherlands relies on an important share of the foreign workforce, as local companies can hire specialists for some departments. This is one of the reasons, the government has created the 30% tax ruling which enables foreign employees to benefit from special treatment from a taxation point of view. Specifically, the employer can pay 30% of their salaries as tax-free allowances. However, this will require special documentation to prove the employee and employer can qualify for this ruling.

Our Dutch accountants can help with the preparation and filing of documentation in order for foreign employees to obtain all their benefits related to working in this country.

Apart from these, Dutch companies with employees abroad must also inform the local tax authorities about their workers which is another aspect our accounting firm can help with, so if you have foreign or transferred employees, do not hesitate to ask for guidance related to their payroll.

The registration of employees for payroll in the Netherlands implies:

- gathering employees’ personal information (copies of identification papers);

- obtaining the citizen service number (BSN) for foreign employees.

There are 19 offices with which employees can be registered for payroll in the Netherlands and our accountants can provide more information on this matter.

As documents that can be used for registering a person as a Dutch employee, the tax authorities will only accept the ID, a valid passport, and a residence permit (the residence sticker on the passport).

Payroll maintenance in the Netherlands

Our accounting firm in the Netherlands will handle the payroll maintenance of your company which implies keeping data on employees and their work contracts. Based on this information, our accountants will calculate the monthly wages, the taxes that need to be withheld, the contributions that must be directed to the relevant authorities, and the filing of the tax returns in due time.

Our accountants use dedicated payroll software to keep all information in order and easy to access. Moreover, all payroll services are guaranteed to be provided by the requirements of the legislation.

You can also rely on us if you need audit services in the Netherlands in addition to the payroll Netherlands solutions we provide for companies of all sizes.

HR solutions for companies in the Netherlands

Before setting up the payroll, a Dutch company must hire employees. In order to do that, it must comply with the Employment Law in order to make sure all work contracts are correct and are registered with the relevant authorities. Even if this is a job for the Human Resources (HR) department, it can be handled by our accountants in the Netherlands who can verify and make sure all employment contracts and additional documents are in order.

Record keeping services in the Netherlands

All Dutch companies with at least one employee are bound by law to keep various records on the respective owner. However, in the Netherlands having one employee is seldom the case, which is why for businesses with a large number of workers we can provide record keeping and updating services.

Dutch business owners must know that they are required to maintain yearly wage statements or payslips for up to 7 years, according to the law. These documents must contain information about each employee, their gross salaries, their net income and all modifications brought to their wages in time. These must be kept in a digital format at our office while the client has access to them all the time.

Our accountants in the Netherlands can maintain and update employee records in a timely manner for employers to not be subject to any penalties imposed by the authorities. We also invite you to watch our video:

Payroll taxes in the Netherlands

The payroll tax in the Netherlands can be a time-consuming and complex demand for an investor just opening a business but fortunately, this is an area where outsourcing is not only possible but also very valuable. That is where Bridgewest steps in, offering through its experienced accountants the help companies need in this detailed area.

The following payroll taxes must be considered in the Netherlands:

- the wage levy;

- the social security contributions;

- the employer insurance premium;

- the income-dependent employer’s health care insurance contribution (where applicable).

A payroll company Netherlands offers solutions for calculating and paying all of these taxes.

Payroll taxes are fees that companies must pay when giving their employees their salaries. There are two categories of payroll taxes: deductions from an employee’s wages and taxes paid by the employer based on the employee’s wages.

The first category is named pay-as-you-earn tax (PAYE), or pay-as-you-go tax (PAYG). These are taxes that employers are required to withhold from employees’ salaries, also known as withholding tax and they often cover payment in advance of social security contributions, income tax, and other insurances like unemployment and disability.

The second category is a fee that the employer must pay from his own funds and that is directly related to employing a worker. These taxes can either be proportionally linked to an employee’s salary or they can consist of fixed charges. The charges paid by the employer usually cover social security and other insurance programs.

Each investor or company that employs in the Netherlands automatically becomes a ‘resident taxpayer’ of the country, and every worker must be offered a contract in accordance with the Dutch payroll tax laws. The employer must administer payroll according to Dutch standards, meaning the company must be registered at the Dutch Payroll Tax Office, and all monthly wages, taxes and social fees must be withheld and paid on time to the Tax Authority.

We are able to provide flexible payroll solutions in the Netherlands that improve payroll management for our clients, and saving their time and resource that can be used to improve business productivity. Thus, our customers can focus on the main activity of their business without concerning about the payroll service. We are a payroll company in Netherlands that takes into account the needs of our clients.

If you need other services, we can put you in touch with our local partners in Romania who can offer you medical services.

Our payroll services in the Netherlands include among others:

- preparation and registration of new employment contracts, as well as amendments to existing ones;

- submitting monthly and annual tax forms related to employees and employers;

- wage transfer to Dutch employees’ accounts;

- drafting and registration of annual leave documentation and subsequent payments;

- preparation of specific employment documentation related to foreign workers;

- income tax and social security withholdings and deductions.

If you have questions related to our HR solutions, do not hesitate to reach out to our Dutch accountants for more information.

Taxation of employees in the Netherlands

The Netherlands levies the personal income tax at progressive rates which rely on the Box taxation system. Based on this system, the amount to be withheld is calculated by the tax authorities here.

Here are the main aspects to consider when dealing with the taxation of employees in the Netherlands:

- the lowest income tax rate paid in the Netherlands is currently set at 18.75%;

- the highest tax rate imposed on individuals is set at 51.75%;

- social security contributions represent 27.65% of an employee’s wage;

- the employer is also required to pay a general unemployment insurance of 3.60%.

One of the advantages offered by the Netherlands is the 30% ruling which implies a tax exemption for foreign employees working in Dutch companies.

Specific characteristics of the Dutch market

In the Netherlands, companies may choose between a manual and an automated payroll system. The automatic payroll process has the advantages of total control and automatic update for payroll changes, but the usage of this procedure requires specific knowledge in this field. The manual payroll process requires more time and does not permit the submission of wage tax in the online option. When working with a payroll company Netherlands, you will not lose the time needed for this procedure.

Foreign companies with employees in the Netherlands must register for a fictitious residence in this country in order to pay taxes. The entrepreneurs must set up a payroll administration and must pay each month the wage tax and premiums for the social security funds or they may work under their foreign Ltd only with the tax authorities’ approval.

There are three categories (boxes) of income:

- Box 1: Income from profits, employment and home ownership;

- Box 2: Income from substantial shareholding;

- Box 3: Taxable income from savings and investments.

For Box1, including the employment income, the following deductions will be levied:

- mortgage interest for primary residence;

- the payment for life insurance;

- funds for alimony;

- medical expenses, other than usual, integrated in an additional category;

- financial support for first-degree relatives;

- in certain conditions the moving allowance may be accepted;

- certain tax credits for single parents, children, and seniors, as provided by the law.

All the persons working in Netherlands (residents and non-residence) must pay the social security contributions, calculated and retained from their gross salary.

Do not hesitate to contact us if you need payroll services in the Netherlands.