The EORI number is required for all Dutch companies that are involved in trading activities at the level of the European Union (EU). The EORI number (Economic Operators Registration and Identification) represents a unique code that is associated with each economic operator. For more detailed information regarding the EORI number and other accounting services, our accountants in the Netherlands are here to help.

EORI number format in the Netherlands

The EORI number in the Netherlands contains the following: the country code (NL for Netherlands) and the unique code created for each Dutch company, which is represented by the fiscal number of the company. In the situation in which the company’s fiscal code is composed of less than 9 numbers, the EORI number will begin with one or two zeros. According to the legislation in the Netherlands, a Dutch EORI number should respect the following sequence: NL + 9 numbers.

| Quick Facts | |

|---|---|

| Applicability |

Import-export activities in the European Union |

|

Operators required to register for EORI

|

EU and non-EU companies |

|

Exceptions from registration |

Economic operators that have obtained EORI numbers in other countries |

| Requirement to obtain an EORI number |

First-time import/export operation in the Netherlands/EU |

| EORI number availability for natural persons (YES/NO) | YES, if engaged in customs operations in the EU |

| Possibility for non-EU operators to register in the Netherlands |

Yes |

| Branch office registration requirements (YES/NO) |

NO, the parent company must apply for EORI registration on behalf of the branch |

| Application procedure | Filing an application form, information on the company with Dutch Customs |

| Recognition of EORI numbers obtained in other EU countries (YES/NO) | YES, Dutch EORI numbers are recognized in all EU countries |

| Possibility to verify existence of an EORI number (YES/NO) | YES, verification to be completed with Dutch Customs |

| Timeframe to obtain EORI number (approx.) | Approx. 4 days |

| Dutch EORI number format | Country code NL plus a 9-digit code (VAT number of the company or personal identification number for natural persons) |

| De-registration from EORI possibility (YES/NO) | Yes |

| Re-registration for EORI requirements | Re-registration imples reassignment of the same EORI number |

| Support in obtaining EORI number (YES/NO) | Yes |

What is the legislation regulating EORI numbers?

As member state of the EU, the Netherlands implemented the legislation stipulated by the European Council. The main rule of law which established the EORI system at the level of the EU is the Regulation (EEC) No. 2913/92, created to implement security measures for the goods traded in this area. The legislation was further amended by the Regulation (EC) No. 648/2005, imposed by the European Parliament the European Council.

Following the implementation of this legislation, the EU has created an EORI database, through which the customs authorities in all the countries that are member states of the Community can access information regarding a specific company trading products here. It is necessary to know that the EU database stores a wide range of information concerning any EORI operator, as follows:

- • the EORI number assigned to a company and the company’s trading name;

- • the place in which the economic operator develops his or her business activities (the country code and the full address of the operator);

- • the value added tax (VAT) identification number, considering the entity must have a VAT number;

- • the legal form under which the business operates and the incorporation date;

- • in the case of a natural person trading goods in the EU, it is necessary to obtain his or her identification data;

- • the full contact information of the person/legal entity and if it is applicable, the main activities developed by an economic operator;

- • the company’s business activities have to be classified following the EC’s classification of economic activities.

We also offer support related to payroll in the Netherlands. We can handle the entire financial process related to computing, paying employees and issuing paychecks in accordance with one’s work on a monthly basis. You can also rely on us for tailored accounting services, in accordance with the size of your business.

Economic operators required to apply for EORI numbers in the Netherlands in 2024

The term economic operator, as it is called under the EORI number application form, refers to both natural persons and legal entities involved in trading activities on the territory of the European Union. In accordance with the regulations imposed by the EU, EORI registration must be completed in the country in which the economic operator is a tax resident (tax residency is a concept applicable to both individuals and companies). This means that the following operators are required to register with the EORI system:

- all natural persons and companies involved in operations with the EU customs authorities;

- all economic operators registered outside the EU but with customs operations on EU territory;

- other persons and companies bound by law to apply for EORI numbers under their national laws;

- EU diplomatic missions could also be required to register for EORI under specific circumstances;

- international organizations, associations and non-governmental organization can also be required to obtain EORI numbers.

Exceptions from obtaining an EORI number in the Netherlands in 2024 are available for those who have relocated here from another EU country in which the economic operator has already been registered in the system. This happens because the EORI number can be obtained once, while its validity extends in all EU countries.

If you are not sure about the requirements for registering for EORI, our Dutch accountants can put you up to date with all specific requirements applying in your situation.

Foreign companies and EORI registration in the Netherlands

The number of foreign companies operating in the Netherlands is not a small one and considering the country has two of the most important port-cities through which trading activities are completed, many of these companies operate in the import-export sector which requires EORI numbers.

There is one important situation that applies to foreign companies seeking to obtain Dutch EORI numbers and that is the local legal entity through which overseas businesses operate in the Netherlands. They can engage in commercial activities through branch offices and subsidiaries.

In the case of branch offices, the EORI number must be obtained through the parent company who can use the assigned number for operations for all its branches. In the case of subsidiaries, each entity must apply for its own EORI number, therefore the parent company might be required to go through the same process. This requisite derives from the fact that the branch office is a dependent entity, while the subsidiary is an independent one.

The main requirement that applies for EORI applicants from other states is to have obtain VAT numbers in their home countries prior to filing for EORI. Companies registered in non-EU countries will benefit from the same treatment when applying for Dutch EORI numbers.

Another aspect to be clarified is that if a foreign company has obtained an EORI number in another country, it will no longer need to apply for registration with the Dutch Customs.

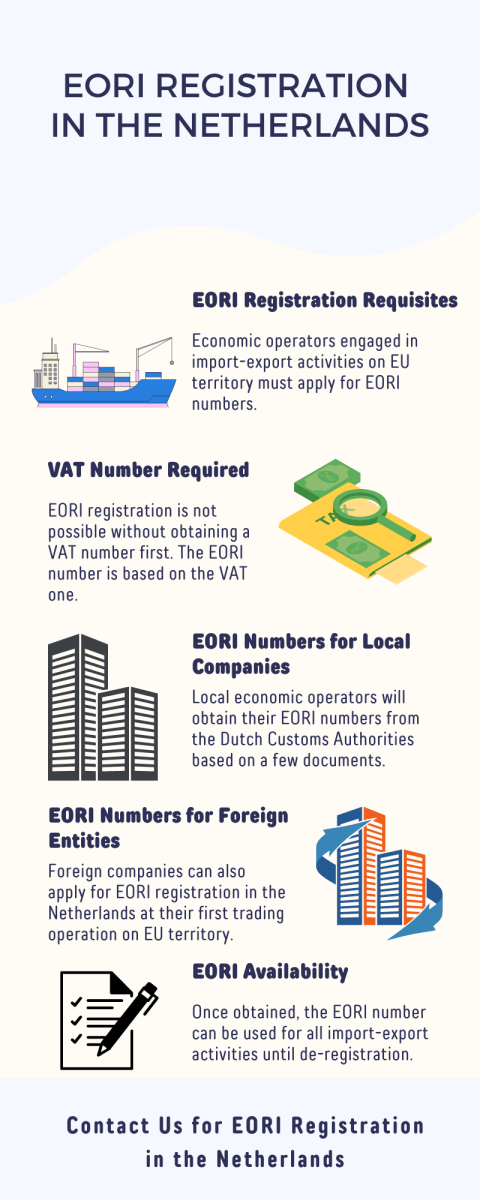

In any case, once obtain, the EORI number will be available in all EU states. Our accounting firm in the Netherlands is at the service of foreign company representatives seeking to register for the EORI system in the Netherlands for the first time. Here is an infographic on this subject:

EORI number assignment in the Netherlands

EORI numbers are only assigned to specific types of entities. Thus, branches cannot have their own Dutch EORI number and must use the one assigned to their head office. The EORI number is assigned by the EU Member State where the company is established. In the Netherlands, businesses with excise tax permits also receive EORI numbers.

This is done to avoid the use of multiple identification numbers for businesses who deal with customs procedures. The requirement to obtain an EORI number for entities that have obtained excise tax permits is determined by the fact that the Dutch customs are in charge with issuing this type of permit and also handles any compliance requirements deriving from this.

Thus, when trading goods as a holder of a excise tax permit, it will be required to use the EORI number as a main means of identification in 2024. This is necessary for the import, export or the trading of goods in the EU or in the Netherlands. Our Dutch accounting firm can provide further information concerning this aspect.

How to apply for an EORI number in the Netherlands in 2024

Companies based in the Netherlands have two main options for receiving an EORI number. Companies in the Netherlands which have a tax reference number do not need to officially apply for an EORI number (since it is comprised of the fiscal number of the company); all Dutch companies which have had customs related activities in the Netherlands before July 1st 2009 have been assigned an EORI number. This also applies to economic operators that are registered as partnerships and which have obtained an identification number in the Netherlands.

Companies that wish to officially apply for an EORI number can complete a standard application form through which their EORI number is published on the European EORI website. In order to obtain an EORI number in 2024, Dutch companies do not need to provide any document. The Dutch customs have access to the required information.

Companies based in non-EU Member States can apply for an EORI number in one of the member states in which they operate. The number is valid in all European Union countries. Companies operating outside the EU are required to provide a document from the trade register, no older than 6 months. The European Union has a central database for all EORI numbers available to the customs authorities in member states.

What forms should I use for the issuance of a Dutch EORI number in 2024?

An economic operator that wants to obtain an EORI number in the Netherlands in 2024 has to submit an application by completing a standard form with the Customs Administration of the Netherlands. The form can be completed as a PDF document and sent via e-mail to this authority.

The form contains two sections regarding the identity of the applicant (the company’s name, its address, the VAT number, the signature of the applicant) and a section dedicated to describing the types of data that will be stored by the Customs Administration and sent to the EU’s database.

Can I verify the EORI number of an economic operator?

Yes, any economic operator is entitled to verify the EORI number of a trading partner. This can be done by accessing the EU’s EORI database, but only in the situation in which the partner has provided his or her consent in using any identification data (such as name or address). It is necessary to know that an entity is not allowed to request from the EU database the EORI number of another entity without prior approval.

The verification of an EORI number of a Dutch company in 2024 can be completed online.

When is the EORI number necessary in the Netherlands?

The EORI number in the Netherlands is necessary for all commercial entities performing trading activities. The assignment of an EORI number is requested by the law when goods are traded through customs. However, the EORI number is required by the customs authorities when trading goods with countries outside the EU.

Still, when trading specific types of goods at the level of the EU, the EORI number will be requested by the customs authorities, for the import-export of products such as alcohol or tobacco. In this case, the goods have to be declared with the local customs authority. Our Dutch accounting firm can provide more information on the regulations addressed to the trade of such goods.

Foreign trade statistics in the Netherlands

In order to understand why EORI registration in the Netherlands is so important, here are the main figures related to trade statistics of this country for the past few years:

- in 2018, foreign trade represented 158% of the country’s Gross Domestic Product (GDP);

- Germany and Belgium are the Netherlands’ main trading partners, with percentages of 22.4%, respectively 10.2%;

- the Netherlands’ trade balance for goods and services for 2018 was 97,5 billion USD;

- in the same year, Dutch exports of goods were worth 723,7 billion USD;

- in December 2021,Dutch exports totaled 711,8 million euros.

Foreign companies seeking to register for EORI in the Netherlands in 2024 do not need to comply with any additional requirement than before. However, if they find difficulties, our Dutch accountants can help them.

For guidance in obtaining an EORI number in the Netherlands at the level of 2024, you can fully rely on our local accounting firm.

Dutch economy to grow

After three quarters of recession, the Dutch economy is expected to increase during the next two years, by 0.5% in 2024 and 1.0% in 2025. Households are expected to spend more despite a small increase in unemployment as their purchasing power is increasing after a prolonged period of high inflation. The Dutch economy is also expected to benefit from increased government consumption and investment in the future years. However, it is expected that firm investments will decline in the next quarters due to rising interest rates. Additionally, a decline in housing investments is predicted as fewer homes are being built.

If you have any questions about registration for import or export procedures, you can discuss with our accountants in the Netherlands. We also invite you to watch a video on this subject:

FAQ on EORI registration in the Netherlands

The verification of the existence of an EORI number can be completed online with the Economic Operator Identification and Registration system.

EORI registration takes a few days to complete.

Yes, once registered in the EORI system, the number will remain with the Customs authorities, therefore after de-registration and re-registration the same number will be assigned.

Yes, you do, if you engage in the import-export of goods within the EU.

For further details regarding the EORI number, we invite you to address to our Dutch accounting firm. Our Dutch accountants can provide more information concerning the registration of an EORI number in this country and can also advise on all the customs procedures available in this case, as well as on the legislation for trading a specific type of product at the level of the European Community.