According to the accounting law in the Netherlands, it is compulsory for every company or other type of corporate entity to submit annual financial statements. In a balance sheet, the company must report on its assets, liabilities and the equity of each owner and must meet the accounting requirements that are established under the local legislation.

The procedure of audit in the Netherlands has to include a set of documents and our Dutch accountants, who have an in-depth experience in performing audit procedures for all types of companies, can advise on the main accounting documents that have to be submitted in this case.

If the company is foreign, the financial statements must be deposited in the origin country and with the Trade Register of the Chamber of Commerce where the main Dutch office is located. In case you have a business elsewhere and you have opened a branch office in the Netherlands, the law usually does not require financial statements, because the branch office is not considered an independent legal structure from its parent company abroad.

| Quick Facts | |

|---|---|

| Audited financial statement filing required (YES/NO) |

Yes |

|

Financial statement filing deadlines |

Within maximum 12 months after the financial year ends, or 8 days from creation, depending on the legal entity. |

|

Mandatory appointment of auditors (YES/NO) |

Yes, independent auditor must be appointed |

| Accepted accounting standards |

Dutch Generally Accepted Accounting Principles (GAAP) and International Financing Reporting Standards (IFRS) |

| Documents to be verified by auditors | Financial statements, annual accounts |

| Content of the financial statement |

Balance sheet, cash flow statement, profit and loss account, directors' report |

| Audit requirements for foreign companies |

Branches of foreign companies must file a copy of the parent company's financial statements in the Netherlands. |

| Corporate tax rate | 15% (for the first 245,000 EUR), 36,750 EUR + 25% for amounts of more than 245,000 EUR |

| Audit services availability (YES/NO) | Yes |

| Types of audit services available | Internal and external audits |

| Audit legislation applicable | Dutch Civil Law, Book 2 and Audit Firms Supervision Act |

|

Annual meeting of shareholders to approve audited financial accounts (YES/NO) |

Yes, the financial accounts must be approved by the shareholders before being filed. |

|

Availability of forensic audit services in the Netherlands (YES/NO) |

Yes, forensic audit services are also available in the Netherlands. |

| Audit exemptions (if any) | Yes, for micro and small companies |

| Regulations to be respected by auditors in the Netherlands |

International Standards of Auditing (ISA) |

| Auditors’ accreditations |

Auditors must be licensed by the AFM (Authority for Financial Markets). |

| Annual filing requirements for companies |

Companies must approve annual accounts 5 months from the end of the financial year and file them 2 months after. |

| Special audit requirements (if any) |

No |

| Appointment of auditors in Dutch companies |

Auditors are appointed by the shareholders. |

| Other services available |

– payroll; – tax registration; – VAT registration; – drafting and filing financial statements, etc. |

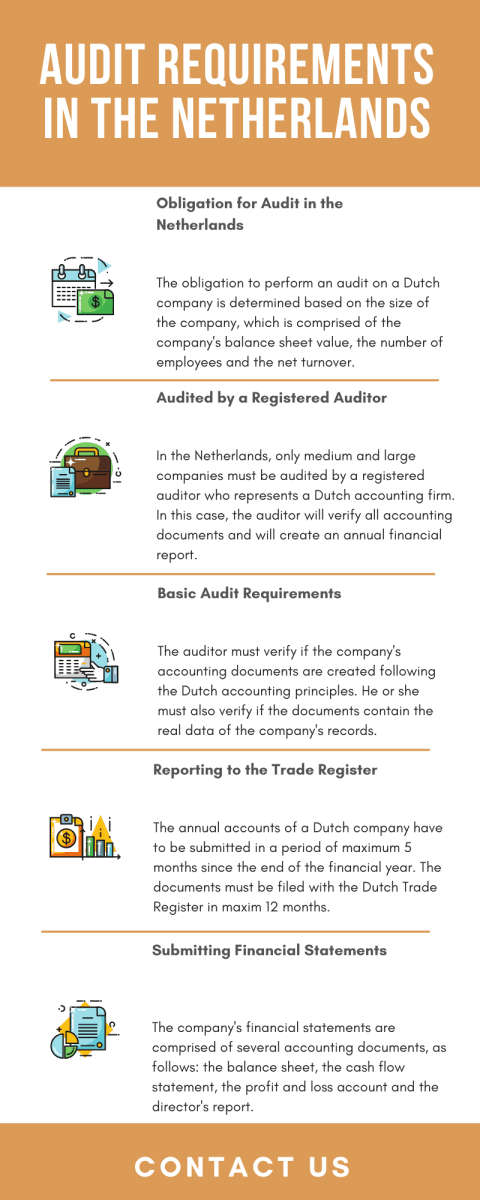

Appointing auditors in the Netherlands

All companies registered under the Company Law must comply with various requirements. Apart from covering the legal requirements one needs to respect when registering a business in the Netherlands, it also provides for the obligations these have, including from a financial point of view.

Dutch companies are required to appoint independent auditors registered with the local regulatory authorities. Upon completing their duties, the auditors will comply with the International Standards of Auditing (ISA) and must meet certain requirements. These may attend the general meetings, however, their main task is to verify and attest to the accuracy of the results of their verifications.

Auditors must be appointed through a shareholders’ meeting, however, it also possible for the supervisory board or managing board to convene to appoint them.

The documents to be audited in Dutch companies are the financial statements and the main purpose of the audit is to ensure their reliability before the shareholders, managers and directors, investors, creditors and banks. These can use the information provided in these statements to make decisions, but also to know how these businesses have performed from an economic point of view and if they have met their scopes. The audited financial statements are accompanied by the auditor’s report.

If you are interested in audit services in the Netherlands, our specialists are at your service. You can rely on us for accounting and audit services tailored to the size of your company.

Audit for small, medium and large companies in the Netherlands

Depending on the size of the company (micro, small, medium or large), the publication, consolidation and audit requirements differ. The size of the company is determined by reference to the value of the balance sheet assets, the net turnover and the number of employees.

In order to be considered a micro company the total value of the assets of a business must be less than EUR 350,000 and the company can have up to 9 employees. The net turnover for a company which is considered small can be of maximum EUR 12 million and the enterprise can hire up to 50 persons.

The following video offers a short presentation on the audit requirements in the Netherlands:

The laws for audit in the Netherlands stipulate that only medium and large companies must create an annual financial report audited by an independent, qualified and registered auditor, from a Dutch accounting firm. Since 2016, the thresholds for the classification of the companies in small, medium and large have increased, thus making many previous large companies to be considered medium or small according the new law.

Since the requirements for smaller companies are lighter, this represented an advantage in terms of accounting for many business owners. As such, a small company will only have to provide an abridged balance sheet and abridged explanatory notes. Medium companies must file a balance sheet abridged to some extent, an abridged profit and loss account, detailed explanatory notes and an annual report.

This auditor is chosen and approved either by the general shareholders meeting, the supervisory board or the managing board of the company. The supervisory or managing boards must first read the auditor’s report and then approve the financial statements. Our team of Dutch accountants can provide in-depth information regarding this aspect.

Audit requirements based on company size

Dutch companies are not subject to the same audit requirements, as their audits are performed based on size which is determined based on the following:

- the value of the assets in the balance sheet;

- the net turnover;

- the total number of employees.

As mentioned above, these are categorized as micro, small, medium, and large businesses based on the characteristics presented earlier.

Based on assets, Dutch companies are categorized as:

- micro if the value of the assets is below 350,000 euros;

- small if the value of the assets is between 350,000 and below 6 million euros;

- medium if the value of the assets ranges between 6 and 20 million euros;

- large if the value of the assets is above 20 million euros.

In terms of net turnover and number of employees, the following criteria apply:

- below 700,000 euros in turnover and less than 10 employees in the case of micro companies;

- between 700,000 and 12 million euros and 10 to 50 employees in the case of small enterprises;

- between 12 and 40 million euros and 50 to 250 employees in the case of medium-sized businesses;

- above 40 million euros and more than 250 employees in the case of large companies.

Our accountants in the Netherlands can offer more information on these categories of enterprises, as well as on the requirements they must comply with. We also offer tailored accounting services based on the size of your business. Also, with our services related to payroll in the Netherlands, you can rest assured that all wage requirements are in compliance with legal and tax filing obligations. The amount of vacation or personal time that employees have used may also be kept on file by our payroll solutions. Feel free to enquire about our other accounting solutions.

What are the audit requirements in the Netherlands?

The auditor’s report must verify if a set of conditions are met. For example, the appointed person must verify if the financial statements contain information in accordance with the principles of accounting firms in the Netherlands and if the financial statements contain accurate information about the financial situation for the respective year. At the same time, the auditor must verify if the management board’s report respects the legal requirements and if the report includes any important additional information.

Starting with the 11th of December 2012, according to the accounting law in the Netherlands adopted by the First Chamber of the Dutch Parliament, an accounting firm in the Netherlands may provide audit services to a company or any type of corporate entity for no more than 8 consecutive years.

Since January 2016 the EU Accounting Implementation Act has introduced several modifications in terms of simplification and modernization of the financial reports and their filing procedure. The annual accounts must be prepared at latest in the fifth month after the end of the financial year and filed with the Dutch Trade Register within maximum 12 months. A delay is punishable by a fine of EUR 20,250 and can also attract the dissolution of the company.

The same law also states that audit firms must separate audit and advisory services, and therefore they can’t provide both audit and advisory services to a corporate entity. Public interest organizations must give a prior notification to the Authority for Financial Markets (AFM) about their intention to appoint an accounting firm for performing audits.

Here is also a video on this subject:

Accounting requirements for Dutch companies

A Dutch business must keep accounting records that are accurate enough to establish its current financial situation at any moment. The duration for which the records should be kept is specified by a number of laws, including civil and tax laws. The records must typically be preserved for a period of 7 years.

There are no particular rules on where the accounting records should be kept. Accounting can be done anywhere, albeit in some cases it should be done in the Netherlands for tax residence reasons. However, the records must be made available upon request within a reasonable amount of time.

A Dutch enterprise may decide to establish its own operational currency instead of keeping financial records in euros. The financial statements be drafted following similar regulations. Generally speaking, all Dutch corporations are required to create annual financial statements, which are then approved by the company’s shareholders. The financial statements are then made public, most frequently by submitting them to the Chamber of Commerce. It usually suffices to provide a copy of the yearly financial statements filed in the foreign company’s home country if it just has a Dutch branch.

Accounting regulations are quite relaxed in terms of the language they can be drafted in, meaning that apart from Dutch, it is also possible to create them in English.

If you need support in accounting matters, our Dutch accountants are at your disposal with tailored solutions.

What does the financial statement contain in the Netherlands?

A financial statement represents an accounting document that records the financial activities of a company registered in the Netherlands. A financial statement is comprised of several other documents and our team of accountants in the Netherlands can provide an in-depth presentation regarding such documents, which are shortly presented below:

- • the balance sheet – it is the main document which prescribes the current situation of the assets and liabilities of the respective company that is audited in the Netherlands;

- • the cash flow statement – it prescribes the current financial situation of the company’s operating activities, as well as its financing and investment matters;

- • the profit and loss account – it presents the company’s net profit and loss;

- • the director’s report – a document that must be filed only by large companies and which is completed by the board of directors, presenting the general financial situation of the business.

Obligation of preparing financial statements in the Netherlands

All companies in the Netherlands are required to draft and file financial statements. Moreover, foreign companies with operations in the Netherlands must also respect these requirements. The only exception applies to branches of foreign enterprises which must file their annual accounts in the country of origin of the parent company, plus a copy of them with the Dutch Trade Register, more specifically with the local office in the Dutch city it operates. However, the branch itself is not required to prepare financial statements, as this is a requirement the parent company must comply with.

Our accounting firm in the Netherlands is at the service of foreign investors and companies with operations here.

The publication of audited financial statements in the Netherlands

Apart from having them drafted and audited, companies are also required to disclose their financial statements by respecting a specific calendar.

Companies must be drafted and approved by the directors within maximum 5 months from the end of the financial year. Then, the shareholders must adopt them no later than 2 months after they have been approved. After that, the company must submit the documents with the Companies Register within 8 days. Failing to respect this calendar will attract penalties.

There is also the possibility of extending the deadlines, however, this requires prior notification with the Trade Registrar. This is one of the main reasons Dutch businesses choose to work with accountants and auditors and discard any omission possibility.

You can rely on our Dutch accounting firm for such services.

Statutory audits in the Netherlands

A statutory audit which is mandated by or according to the Audit Firm Supervision Act, is a review of a company’s or institution’s financial accountability for various purposes. A Dutch registered auditor or an accounting consultant who is qualified to certify financial statements must create consolidated financial statements and/or audit the company’s financial statements.

Compared to other types of audits in the Netherlands, this is not a mandatory financial verification of a company, such audits usually being requested by company owners when considered necessary.

Apart from financial and statutory audits, there are also company checks that can be performed on a Dutch company. Our accounting firm in the Netherlands can offer several types of audits.

Audits for group of companies in the Netherlands

Many companies decide to operate in the Netherlands through several subsidiaries. These are usually holding companies that own partially or fully other entities. In their case, special audit requirements may apply in the sense that they can consolidate their financial statements to simply their accounting.

In the Netherlands, the consolidated financial statements’ format and content are identical to those of the company financial statements, with the exception of a few legal matters and a few other items.

The financial statements typically include the following:

- consolidated financial statements, which include a consolidated balance sheet, profit and loss account, cash flow statement, and notes to the consolidated financial statements.

- the company’s financial statements, which include the following: a balance sheet, a profit and loss account, and notes to the financial statements.

The information used to compile consolidated financial statements must be no more than 3 months old or no more than 3 months old when compared to the date of the consolidated balance sheet.

The accounts can be prepared in accordance with the parent company’s accounting rules rather than Dutch GAAP, provided that the parent company’s accounting standards adhere to the general requirements for proper bookkeeping as stipulated by Dutch law.

What are the main accounting regulations in the Netherlands?

The accounting principles that are developed in the Netherlands are regulated by the Dutch Generally Accepted Accounting Principles (GAAP), which are created following the European Union’s legislation on the matter. At the same time, it is necessary to know that numerous accounting principles established under the Dutch GAAP are compatible with the International Financing Reporting Standards (IFRS).

In the case of businesses operating in the Netherlands that are part of an international group of companies registered in the EU, they may also provide their financial statements following the accounting legislation in the respective EU states. However, this option has to be mentioned in the notes attached to the company’s financial statements; our accounting firm in the Netherlands may offer further advice concerning this aspect.

For more details on this topic and personalized consultancy for your business please contact our accounting firm in the Netherlands.Our Dutch accountants can offer in-depth information concerning the audit procedures available for your type of company operating in the Netherlands and can also advise on any other accounting procedure applicable here.